louisiana estate tax rate

The millage rate is used to calculate the property tax rates on bills. In Louisiana the median property tax rate is 551 per 100000 of assessed home value.

Property Tax In The United States Wikipedia

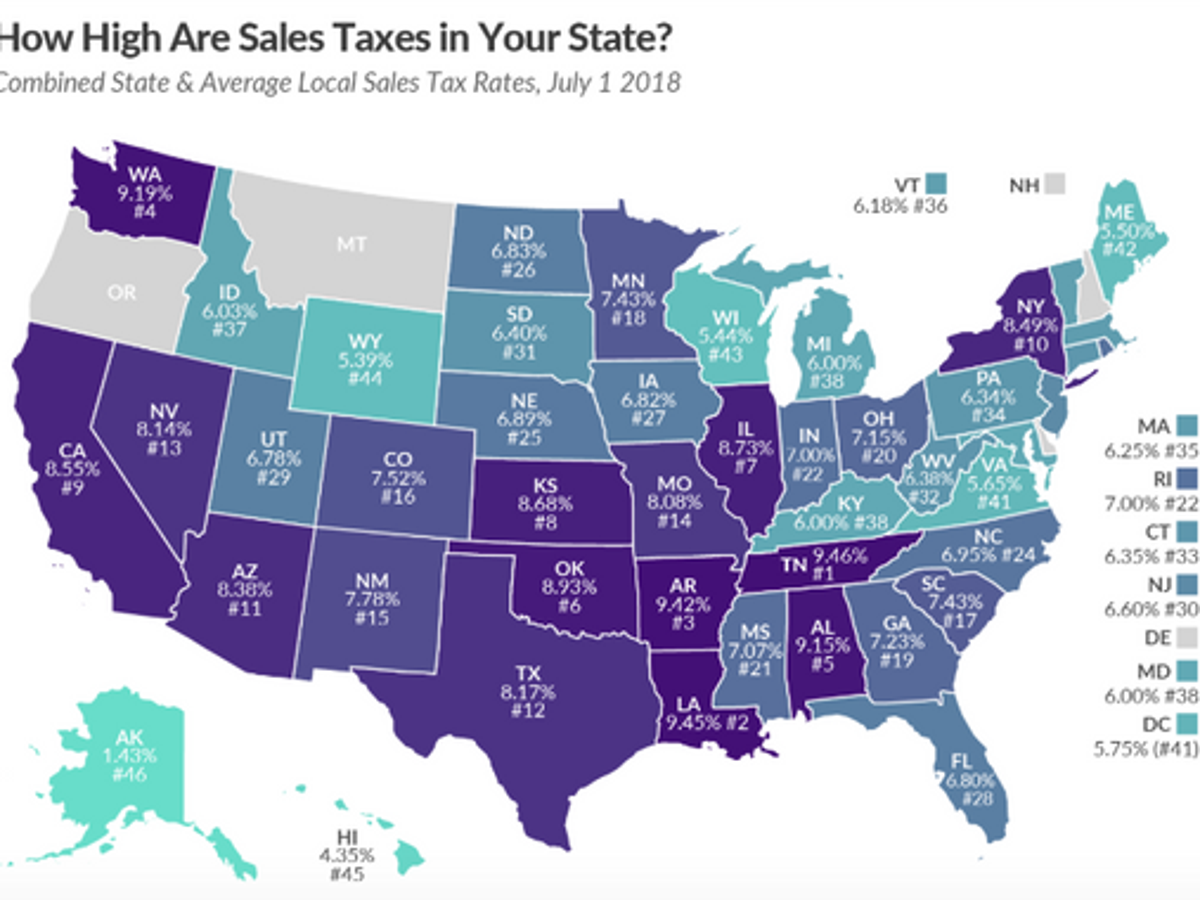

Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018.

. But just because Louisiana does not have an estate tax does not mean that the same is true for the federal government. 6 2022 to claim millions of dollars in state income tax refunds before they become unclaimed property. Louisiana has a 445 percent state sales tax rate a max local sales tax rate of 700 percent and an average combined state and local sales tax rate of 955 percent.

The underlying income tax brackets are unchanged from last year. The median property tax in Louisiana is 24300 per year018 of a propertys assesed fair market value as property tax per year. For periods beginning on or after January 1 2022 fiduciaries are taxed on net income computed at the following rates.

The Louisiana Department of. Your average tax rate is 1198 and your marginal. Our property tax data is based on a 5-year study of median property tax rates.

Groceries are exempt from the Louisiana sales tax. Louisiana does not levy an estate tax against its residents. The median property tax in Louisiana is 24300 per year.

Median Income In Louisiana. Revenue Information Bulletin 18-017. Learn all about Louisiana real estate tax.

There is one mill for every 1000 of net taxable value. The Louisiana tax rates decreased from 2 4 and 6 last year to 185 35 and 425 this year. The Legal Department can be reached at 318-329-2240.

BATON ROUGE Louisiana taxpayers have until Oct. Counties and cities can charge an. Louisiana Income Tax Calculator 2021.

Louisiana Property Tax Breaks for Retirees. An estate or trust may make estimated. If you make 70000 a year living in the region of Louisiana USA you will be taxed 12317.

The Economic Growth and Tax Relief Reconciliation Act of. However because of the varying tax. 2 Contact the Tax Revenue office 318-329-2220 select Property Tax to get the amount of taxes penalties interest and costs.

The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax. Louisiana has one of the lowest median property tax. On average a homeowner pays 505 for every 1000 in home value in property taxes with the average Louisiana property tax bill adding up to 832.

The property tax rate in Louisiana is listed below. The Louisiana state sales tax rate is 4 and the average LA sales tax after local surtaxes is 891. Declaration of Estimated Tax.

Whether you are already a resident or just considering moving to Louisiana to live or invest in real estate estimate local property tax rates and learn. Subsequently the total tax rate. Louisiana property tax rates are set by different taxing districts depending on the amount of revenue they need to generate from property taxes.

Property Tax Calculator Smartasset

Sales Tax Rates Louisiana Department Of Revenue

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Creating Racially And Economically Equitable Tax Policy In The South Itep

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation

State Sales Tax Rates Tax Policy Center

Filing Louisiana State Tax Things To Know Credit Karma

Estate And Inheritance Taxes By State In 2021 The Motley Fool

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com

Creating Racially And Economically Equitable Tax Policy In The South Itep

St John The Baptist Parish Assessor Louisiana Property Tax

Talk Taxation In The United States Archive 3 Wikiwand

The Average Amount People Pay In Property Taxes In Every Us State

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State By State Estate And Inheritance Tax Rates Everplans

Louisiana La Tax Rate H R Block

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Are There Any States With No Property Tax In 2022 Free Investor Guide

Are There Any States With No Property Tax In 2022 Free Investor Guide