mississippi state income tax brackets

Earlier this session tax cut plans touted by the leadership of both the House and Senate included a cut to the grocery tax in addition to. Taxpayer Access Point TAP Online access to your tax account is available through TAP.

Mississippi Income Tax Calculator Smartasset

Mississippi Income Taxes.

. Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time. 4 rows Mississippi state income tax rate table for the 2020 - 2021 filing season has four income. Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the top rate for the majority of their income.

AP Mississippi residents will pay lower income. 4 on the next 5000 of taxable income. The Mississippi State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Mississippi State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

The 5 tax on remaining income will drop to 47 for 2023 then 44 for 2025 and 4 starting in 2026. For those earning more than. If youre married filing taxes jointly theres a tax rate of 3 from 4000 to 5000.

Your 2021 Tax Bracket to See Whats Been Adjusted. 4 rows Mississippi state income tax rate table for the 2020 - 2021 filing season has four income. Mississippi State Personal Income Tax Rates and Thresholds in 2022.

Discover Helpful Information and Resources on Taxes From AARP. Tax Bracket Tax Rate. If you are receiving a refund.

4 rows The Mississippi income tax has three tax brackets with a maximum marginal income tax. In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately. Explore The Top 2 of On-Demand Finance Pros.

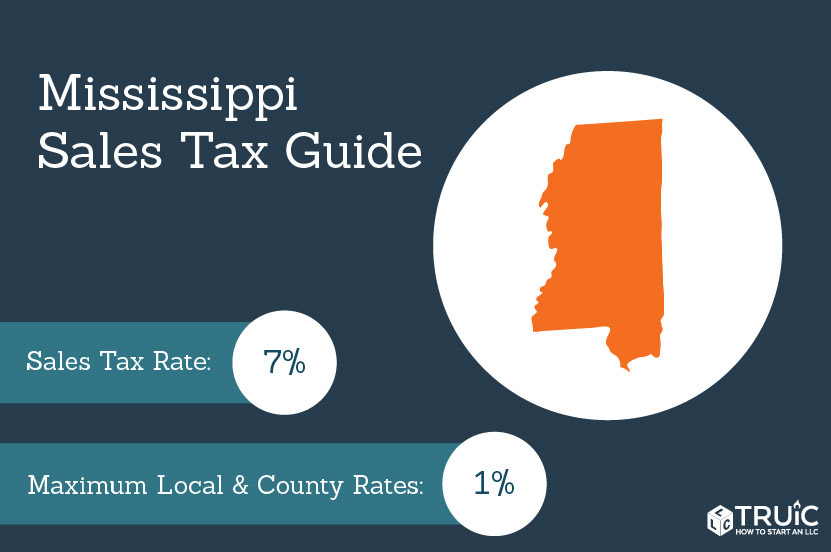

The remaining states and Washington DC. Mississippis political leaders have talked for years about cutting the 7 tax on groceries the highest statewide tax of its kind in the nation in its poorest state. The graduated income tax rate is.

Give Mississippi when fully implemented the fifth-lowest marginal tax rate for states that have income tax although other states are also considering cuts or. There is no tax schedule for Mississippi income taxes. A State-by-State Comparison of Income Tax Rates.

For single taxpayers your gross income must be more than 8300 plus 1500 for each dependent. The tax brackets are the same for all filing statuses. The more you earn the higher the percentage youll pay in income tax on your top dollars.

0 on the first 2000 of taxable income. 3 on the next 3000 of taxable income. The Mississippi Department of Revenue is responsible for publishing.

Mississippi Income Taxes. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. Detailed Mississippi state income tax rates and brackets are available on this page.

The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. 5 on all taxable income over 10000. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5.

3 rows Mississippis income tax brackets were last changed four years prior to 2020 for tax year. Because of tax cuts approved years ago the tax-free amount will increase to 13300 after this year. Eliminate the states 4 tax bracket on peoples first 5000 of taxable income starting 2023.

All other income tax returns. 0 on the first 3000 of taxable income. Any income over 10000 would be taxes at the highest rate of 5.

Charge a progressive tax on all income based on tax brackets. In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately. But those efforts never go anywhere.

For example Californias top rate is 133 but youll only pay this on income over 1 million. Title 27 Chapter 13 Mississippi Code Annotated 27-13-1. The state has a 4 tax on the next 5000 of income and a 5 tax on all income above that.

The first 4000 of taxable income is exempt. As you can see your income in Mississippi is taxed at different rates within the given tax brackets. Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the top rate for the majority of their income.

Mississippis 3 Percent Income Tax Rate Will Phase Out by 2022. Ad Compare Your 2022 Tax Bracket vs.

Mississippi Tax Rate H R Block

Tax Rates Exemptions Deductions Dor

State W 4 Form Detailed Withholding Forms By State Chart

Qod How Many States Do Not Have State Income Taxes Blog

Tax Rates Exemptions Deductions Dor

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Mississippi Sales Tax Small Business Guide Truic

Mississippi Tax Rate H R Block

Mississippi Income Tax Calculator Smartasset

Mississippi Tax Forms And Instructions For 2021 Form 80 105

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Best States To Retired In With The Lowest Cost Of Living Gas Tax Federal Income Tax Income Tax

States With Highest And Lowest Sales Tax Rates

How Do State And Local Individual Income Taxes Work Tax Policy Center

Filing Mississippi State Tax Returns Things To Know Credit Karma Tax

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)